Testing the Waters: Three SHORT Swing Trade Setups

Small-risk trades in shifting market conditions

After last Friday’s sharp sell-off - the worst trading day since April - the S&P 500, Nasdaq, and Russell 2000 all saw heavy losses. Renewed trade-war fears triggered broad-based weakness, and while the long-term market trend remains bullish, short-term momentum clearly shifted to the downside.

In such an environment, it makes sense for swing traders to remain flexible. Rather than betting entirely against the broader trend, we have identified three short positions, known as “test positions,” which are intended to gauge whether the recent weakness could develop into something more significant.

Let’s take a closer look.

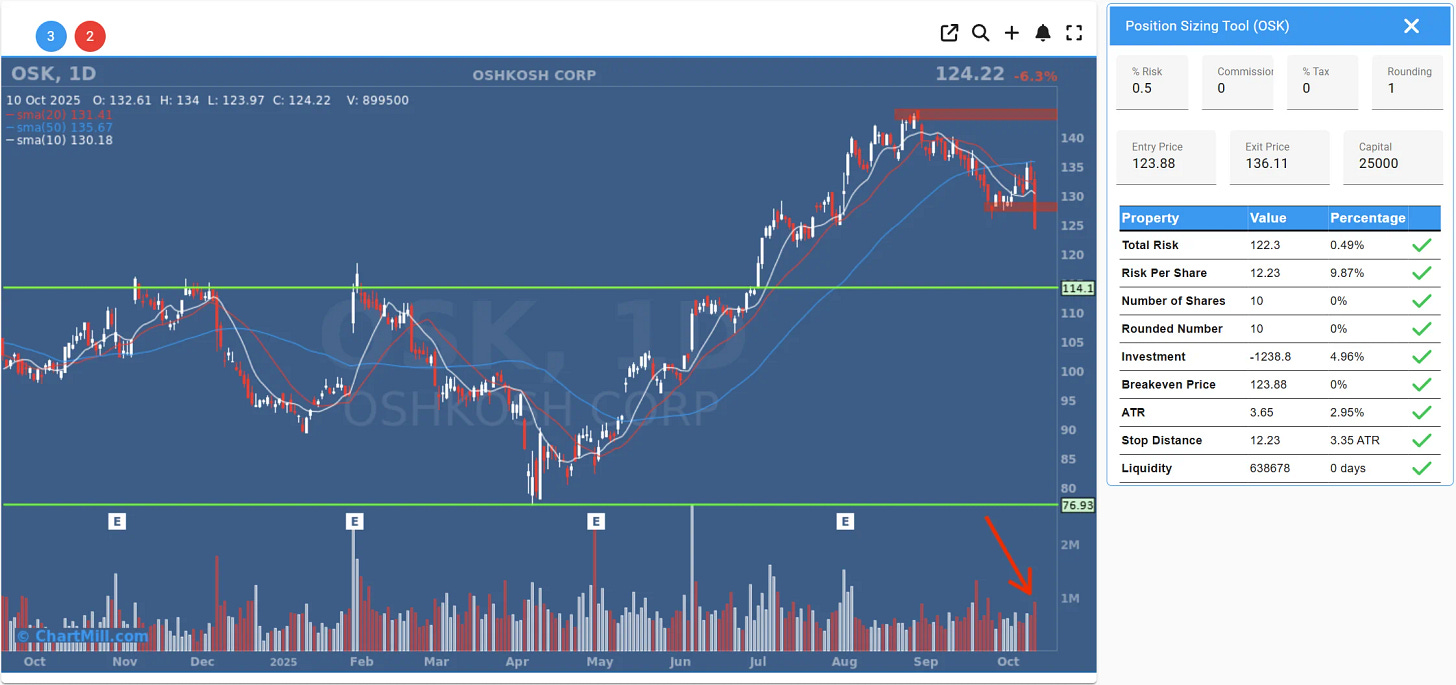

1. Oshkosh Corp (OSK)

Entry: $123.88

Stop: $136.11

Risk per Trade: 0.5% of capital

ATR Multiple: 3.35x

OSK recently broke below short-term support around $126 on increased volume, a clear sign of selling pressure. The stock had been consolidating near its highs but failed to regain momentum, and the breakdown triggered a shift in short-term trend direction.

With a stop placed above the recent consolidation range, this setup keeps risk tightly controlled while allowing room for a potential move toward the next support level near $114.

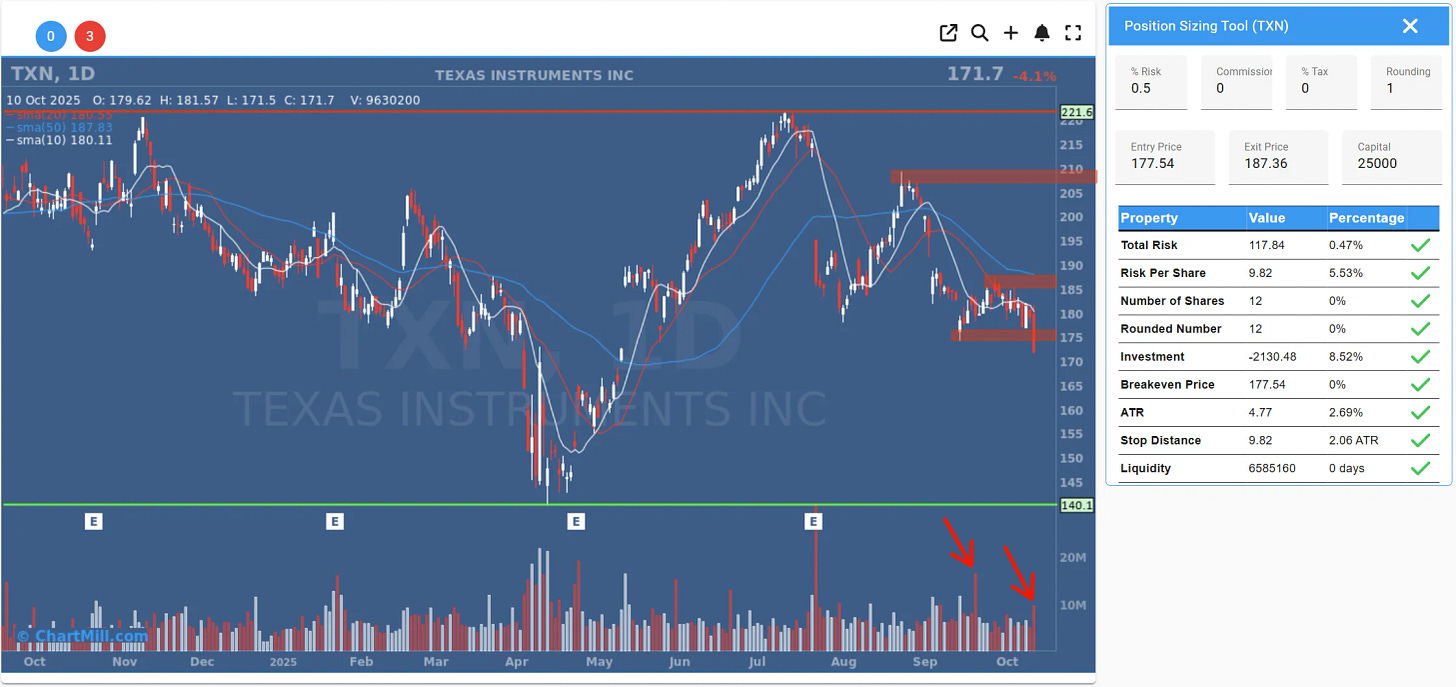

2. Texas Instruments (TXN)

Entry: $177.54

Stop: $187.36

Risk per Trade: 0.5%

ATR Multiple: 2.06x

TXN has been forming a series of lower highs and lower lows since July. Last week’s bearish candle, accompanied by strong volume, confirmed the weakness and the failure of buyers to defend the $180 area.

This setup looks for continuation toward the $140 zone, which aligns with prior support from the spring period. As always, risk is capped and defined, an essential component of any professional trading plan.

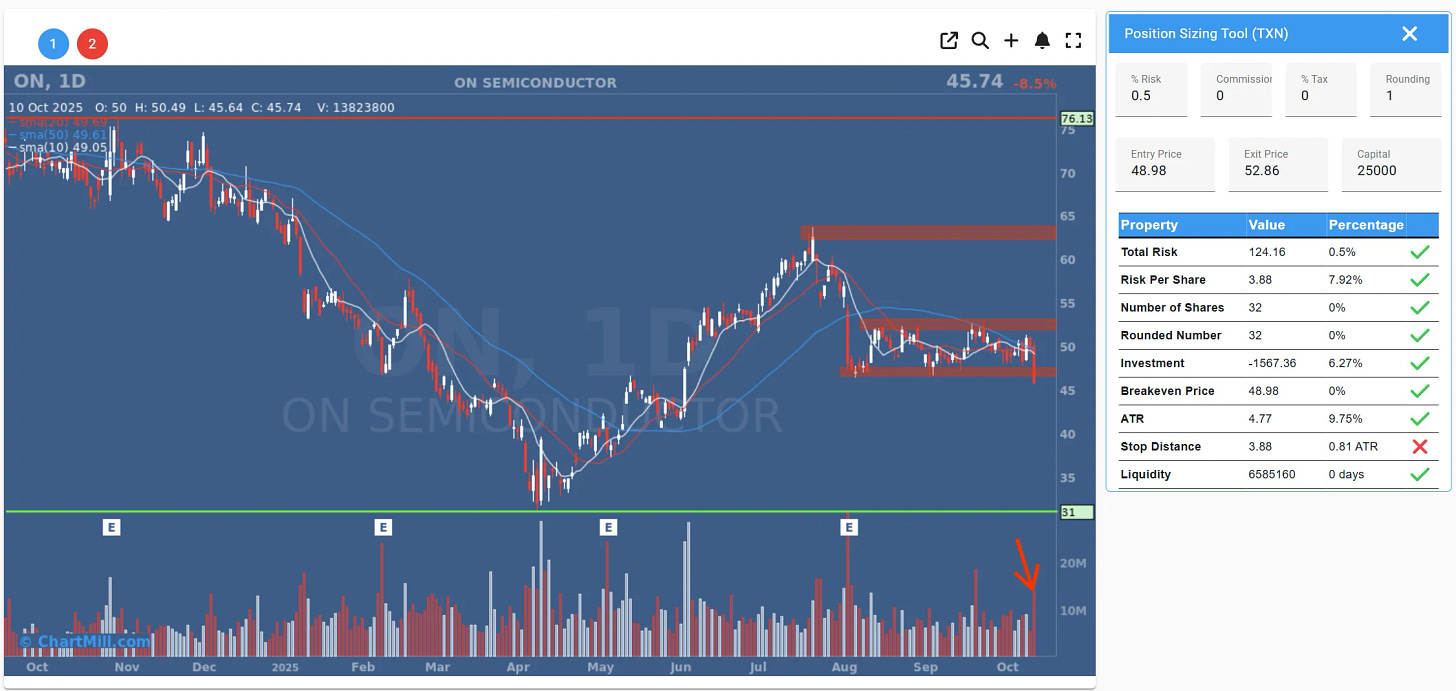

3. ON Semiconductor (ON)

Entry: $48.98

Stop: $52.86

Risk per Trade: 0.5%

ATR Multiple: 0.81x

ON Semiconductor completed a breakdown from a broad sideways range between $45 and $50. Volume spiked on the downside break, confirming heavy selling. The chart now shows a clear lower high followed by a decisive push through support, a classic bearish continuation setup.

Although the stop distance is less than 1 ATR, making it somewhat tight, the low risk allocation compensates for that. If momentum accelerates, this could offer a quick short-term profit opportunity.

Why These Are “Test Positions”

Even though these setups are bearish, the long-term market trend still favors the bulls. That’s why we’re keeping our risk per trade small (0.5%), effectively dipping a toe in the water rather than diving headfirst.

If these trades move in our favor, it could confirm a deeper pullback phase in the market, opening the door for larger short opportunities. If they fail, the total drawdown remains minimal, exactly how disciplined risk management should work.

The Key: Risk and Money Management

In swing trading, position sizing and capital preservation matter more than finding the “perfect” setup. Every trade carries uncertainty, but by controlling position size, defining stops in advance, and respecting market context, traders can build long-term consistency, even with a 50% win rate.

Want to Learn Swing Trading Step by Step?

If you want to understand how to identify setups like these, manage risk effectively, and avoid the most common trading pitfalls, make sure to check out our brand-new Swing Trading Course.

This e-course explains:

What swing trading really is and how it differs from day or position trading.

How ChartMill helps find the best candidates for various swing trading strategies.

Why risk management and position sizing are the backbone of consistent profits.

The psychological traps and technical mistakes most traders make and how to sidestep them.

Whether you’re new to trading or looking to refine your process, this course will give you a complete, structured foundation for long-term success.

Final Thoughts

Market conditions can shift quickly and successful swing traders adapt just as fast.

The current setups in OSK, TXN, and ON represent small, controlled contrarian trades against a still-bullish backdrop.

Whether they play out or not, the focus remains the same: protect capital first, manage risk, and let the market prove you right (or wrong).

Trade Safe!

Kristoff - ChartMill