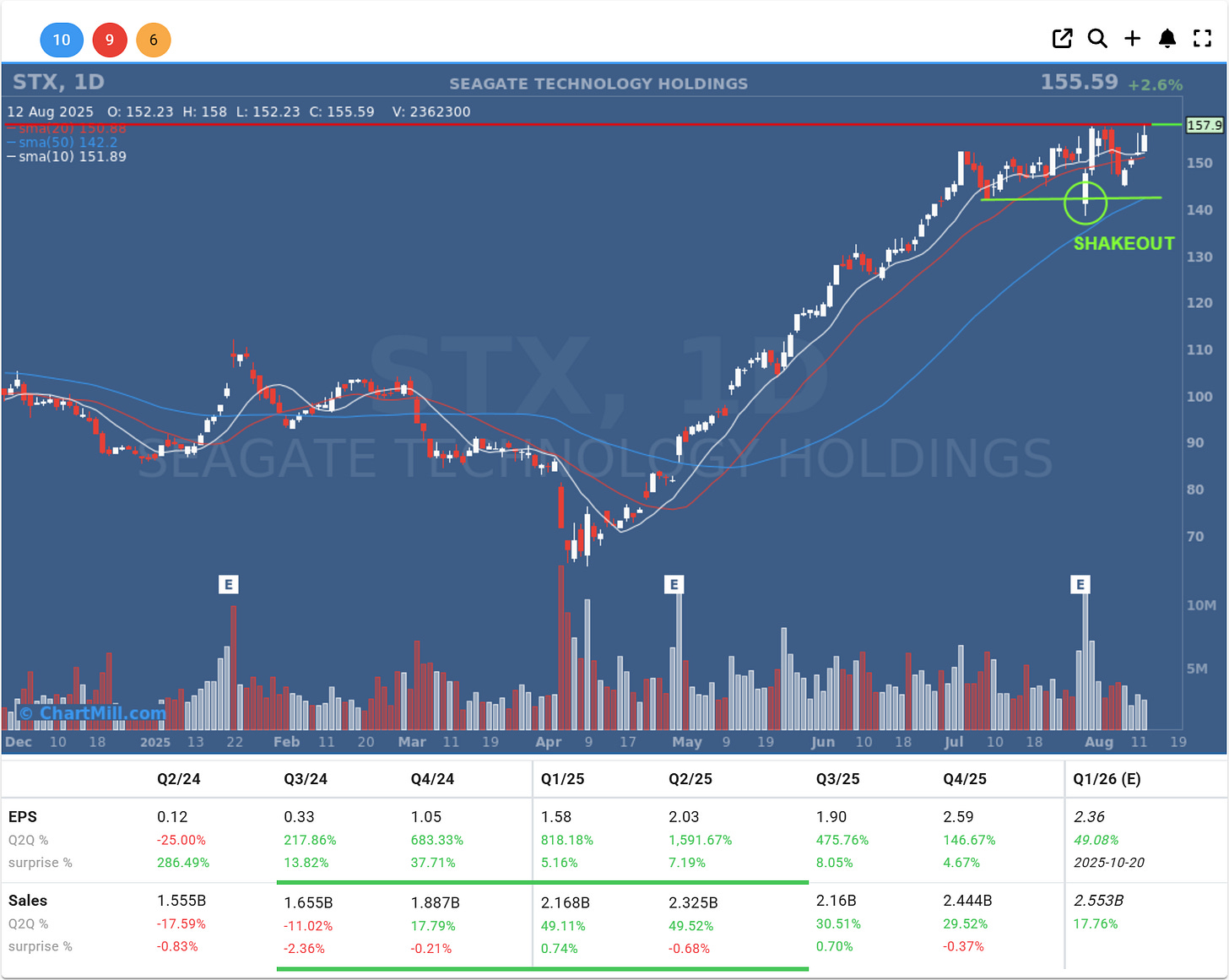

Today’s setup is in Seagate Technology Holdings (STX), where the price action is signaling a possible breakout continuation in a strong uptrend.

After a sharp rally from the April lows, STX consolidated in a tight range just below resistance. On July 30, the stock gapped down sharply at the open following its Q4 2025 earnings release, triggering a brief shakeout under short-term support.

This move likely flushed out weaker holders, but the dip was quickly bought up, and price recovered to retest the highs within just a few sessions.

Why this setup stands out:

Uptrend intact – Both the 10-day and 50-day moving averages are sloping upward, confirming momentum.

Earnings shakeout recovery – The post-earnings gap down failed to break the uptrend, showing strong underlying demand.

Breakout potential – Price is now challenging the prior highs near $158, a clear resistance zone.

Risk Management

For this trade, I’m using a 1% total account risk with a stop distance of 2.2 ATR. This places the stop level at approximately 8.68% below the entry. The ATR for STX is currently 3.92% of price, which fits well within my volatility tolerance.

Trade Plan:

Entry Trigger: Breakout above ~$158 resistance.

Stop Loss: Below the July 30 shakeout low.

Target: Let the trend run, with partial profits taken if momentum extends quickly post-breakout.

With earnings growth surging over the last few quarters and sales momentum staying strong, STX has both the technical and fundamental backdrop for a sustained move, provided this breakout attempt is confirmed.

If the stock clears resistance on volume, this could mark the next leg in the ongoing uptrend.

Kristoff - ChartMill