MDXH Forms a High-Tight Flag: A New Swing Trading Opportunity

ChartMill’s screen highlights a textbook continuation pattern in MDXH

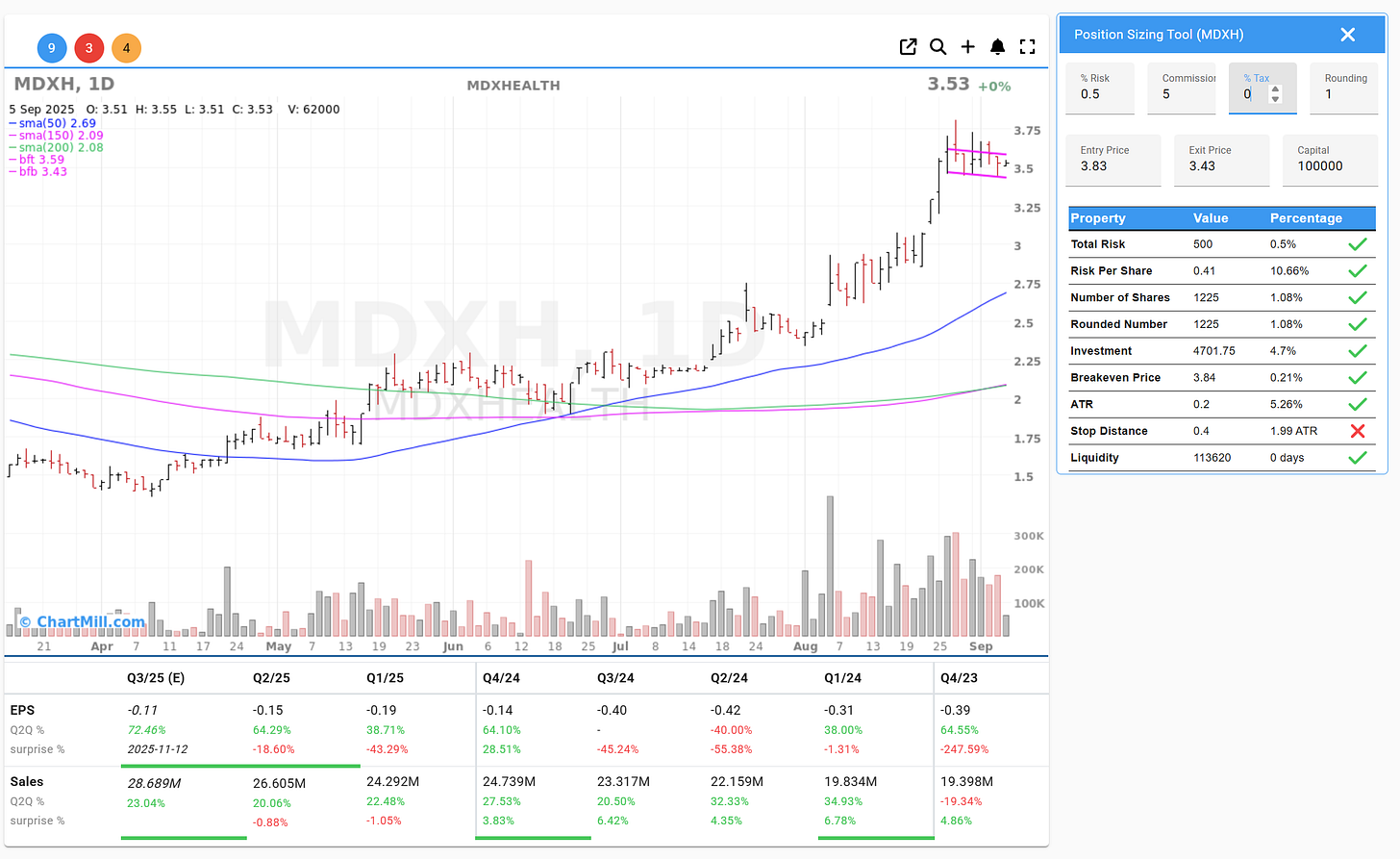

A fresh swing trading opportunity has emerged in MDxHealth (NASDAQ: MDXH), which recently formed a classic high-tight flag pattern. This technical setup often signals strong continuation potential when accompanied by volume and fundamental support.

The High-Tight Flag Setup

MDXH has been in a strong uptrend, rallying sharply in recent weeks. After the initial surge, the stock began to consolidate in a tight sideways pattern just below recent highs. This type of high-tight flag formation is often interpreted as constructive, as it allows the stock to digest prior gains without giving up much ground.

The technical picture shows:

Price trading above all key moving averages (50-, 150-, and 200-day).

A well-defined flag zone near $3.50–$3.75.

Entry point at $3.83 with a stop set at $3.43, based on the ChartMill position sizing tool.

Fundamentals Add Support

MDXH’s recent quarterly results show positive revenue trends. Sales have grown consistently across the last five quarters, with year-over-year increases ranging from 20% to 34%. EPS remains negative but has shown signs of gradual improvement. For swing traders, this steady revenue growth provides a fundamental backdrop that aligns well with the bullish chart setup.

Risk Management

According to the ChartMill Position Sizing Tool, a trader with a $100,000 account risking 0.5% per trade would size this position as follows:

Number of shares: 1,225

Total investment: $4,701.75 (≈4.7% of account)

ATR (14): $0.20, with a stop distance of $0.40 (≈1.99 ATR)

This keeps risk controlled while allowing participation in a potential breakout.

See How I Found It

I’ve just created a video walkthrough showing exactly how I spotted this setup using ChartMill’s screening tools. If you’d like to see the step-by-step process and how the high-tight flag was identified, make sure to check it out in the video below.

Important Note

As always, keep in mind that not every setup works out. Losses are a normal and necessary part of swing trading. This article is intended solely to highlight the screening capabilities of ChartMill and should not be taken as financial advice or a recommendation to buy or sell MDXH. At the time of writing, the author has no position in MDXH.

Stay Connected

If you enjoy these types of swing trading breakdowns and want to see more setups like this, consider subscribing to my free Substack. You’ll get regular updates on market leaders, chart patterns, and educational insights on how to use ChartMill effectively.