I’ve seen my fair share of volatile trading days, but what unfolded this past Friday reminded me how quickly sentiment can shift when geopolitics takes the driver’s seat.

I’d barely settled into the afternoon session when headlines started flashing: Iran had launched missiles toward Israel. That was all the market needed to go into full risk-off mode.

By the closing bell, the Dow Jones had shed 1.8%, and the Nasdaq wasn’t far behind with a 1.3% drop. The timing of the escalation, right into the final trading hours, meant traders had little time to reposition. The selloff was fast and broad, except in a few predictable corners.

Flight to Safety – Gold, Oil, and Defense Steal the Show

There’s nothing like real geopolitical tension to bring the usual suspects to life.

Gold surged again, closing at $3,455/oz, approaching all-time highs.

Oil didn’t sit still either. WTI crude shot up over 7% intraday, clocking a stunning 13% weekly gain.

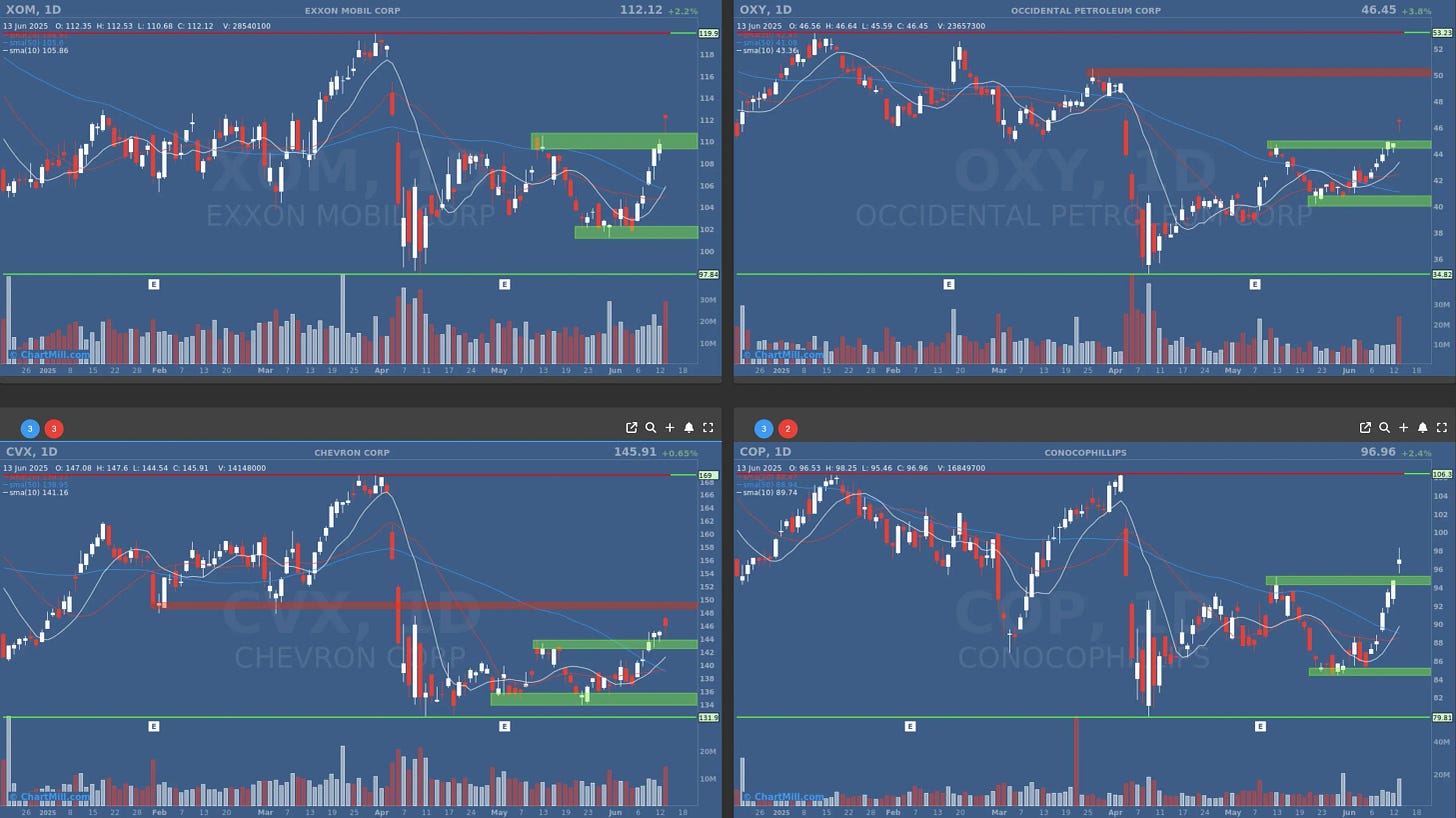

Energy stocks, naturally, caught a strong bid.

Chevron (CVX | +0.65%), Occidental Petroleum (OXY | +3.78%), ConocoPhillips (COP | +2.4%), and Exxon Mobil (XOM | +2.18%) all benefited as the Strait of Hormuz - key for global oil flow - now feels like a risky bottleneck.

Defense names were another bright spot. The usual go-to names, Lockheed Martin (LMT | +3.66%), Northrop Grumman (NOC | +3.94%), and L3Harris Technologies (LHX | +2.64%) were bid up across the board. These are classic plays when things get ugly geopolitically. And ugly it is.

Israeli Defense Minister Israël Katz says Iran crossed a red line by targeting civilian areas, and Israel’s response is likely to be anything but measured. That means more defense budgets, and Wall Street knows it.

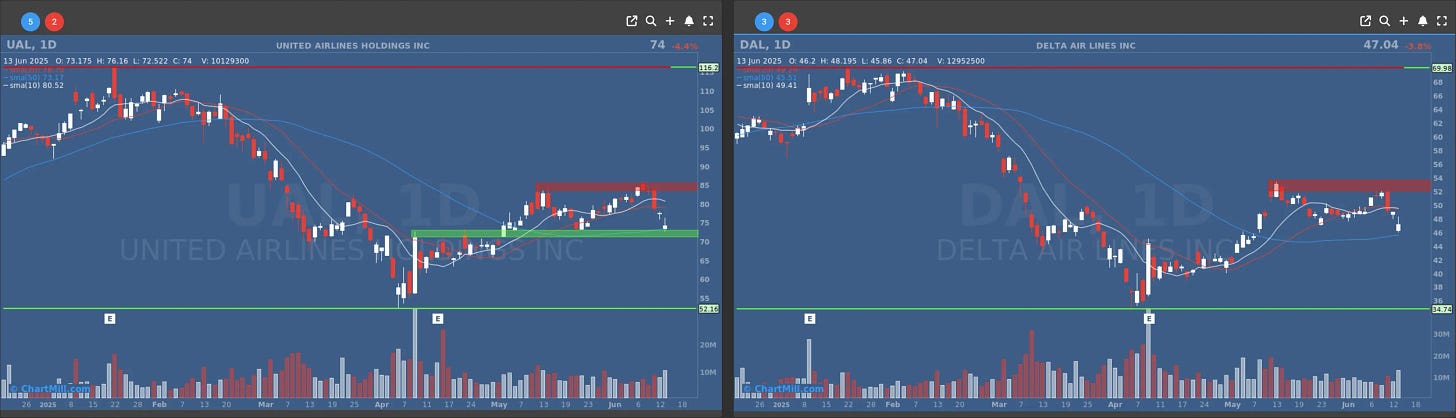

Airlines Tank – Airspace Closed, Fuel Costs Soar

In sharp contrast, airline stocks were taken to the woodshed. Middle Eastern airspace closures forced major rerouting, which is bad enough, but add in spiking fuel prices, and you’ve got a recipe for pain.

United Airlines (UAL | -4.43%) and Delta Air Lines (DAL | -3.76%) both got hit hard, dropping between 4% and 5%. No surprise there. These stocks are extremely sensitive to oil and geopolitical risk, and Friday they got both in one nasty dose.

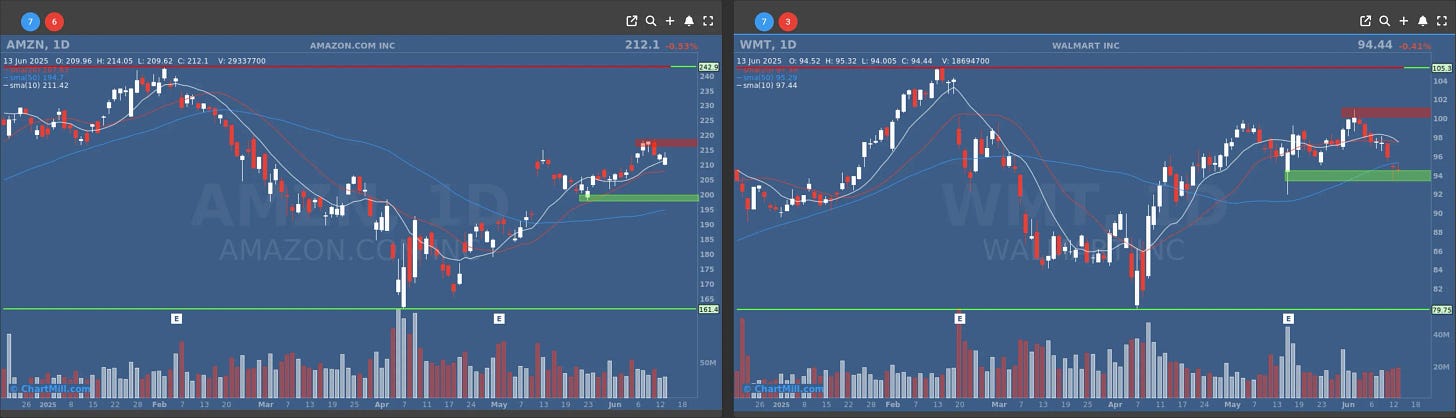

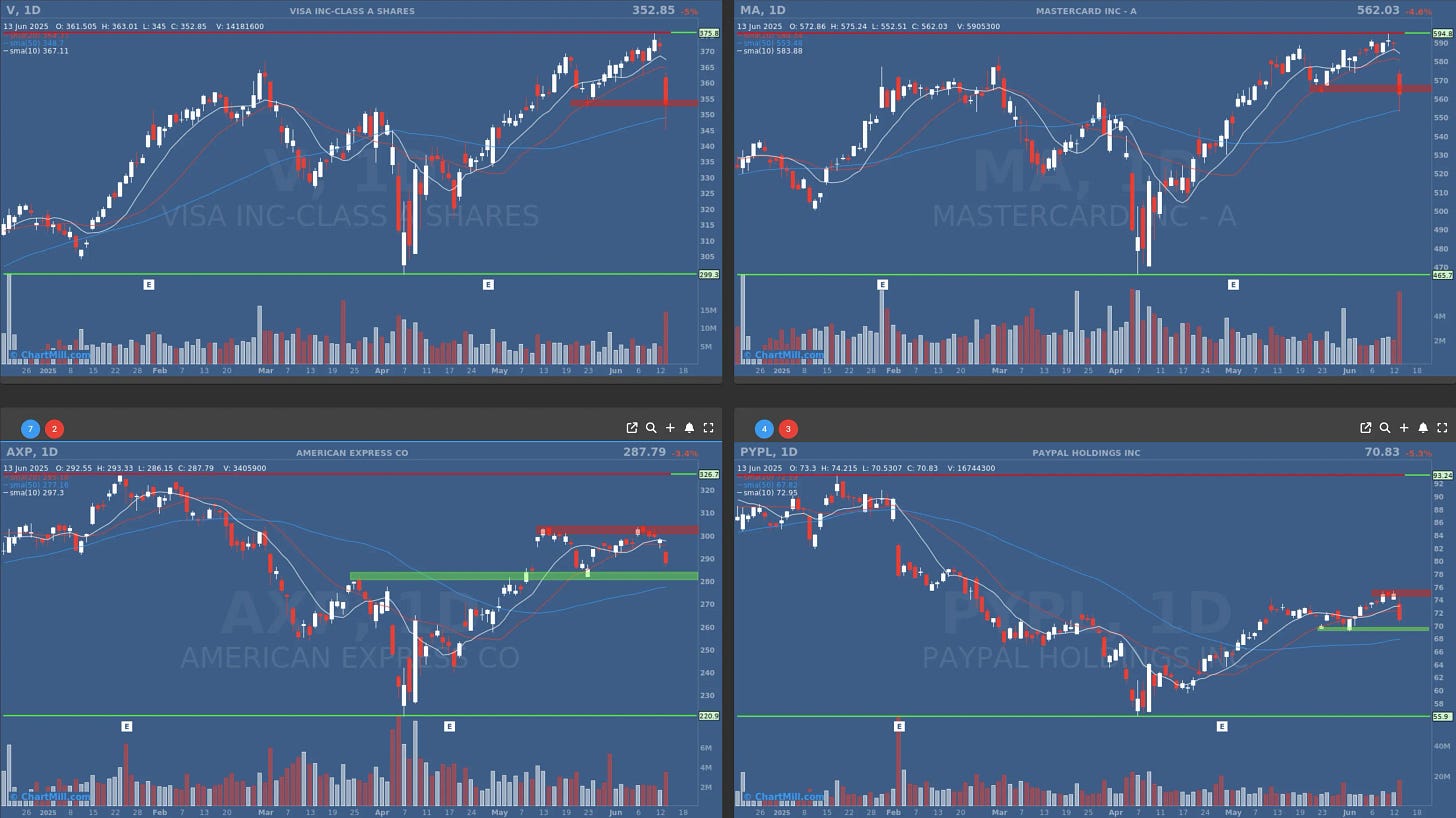

Tech and Fintech Under Fire

One story that flew under the radar (but shouldn’t have) was a Wall Street Journal piece hinting that Walmart (WMT | -0.41%) and Amazon (AMZN | -0.53%) are looking into launching their own stablecoins. That’s a direct threat to traditional payment players... and markets took notice.

Visa (V | -4.99%), Mastercard (MA | -4.62%), American Express (AXP | -3.42%), and PayPal (PYPL | -5.32%).all sold off.

Adobe Under Pressure Despite Solid Results

Then there’s Adobe (ADBE | -5.3%), which reported solid numbers and even raised guidance, yet the stock tanked. I've seen this movie before: investors love AI, but they’re just not buying Adobe's storyline right now.

Tools like Canva and Midjourney are chipping away at Adobe’s core offerings with aggressive (and often free) AI features. Adobe’s year-to-date decline now sits at -11%, and sentiment is clearly turning bearish.

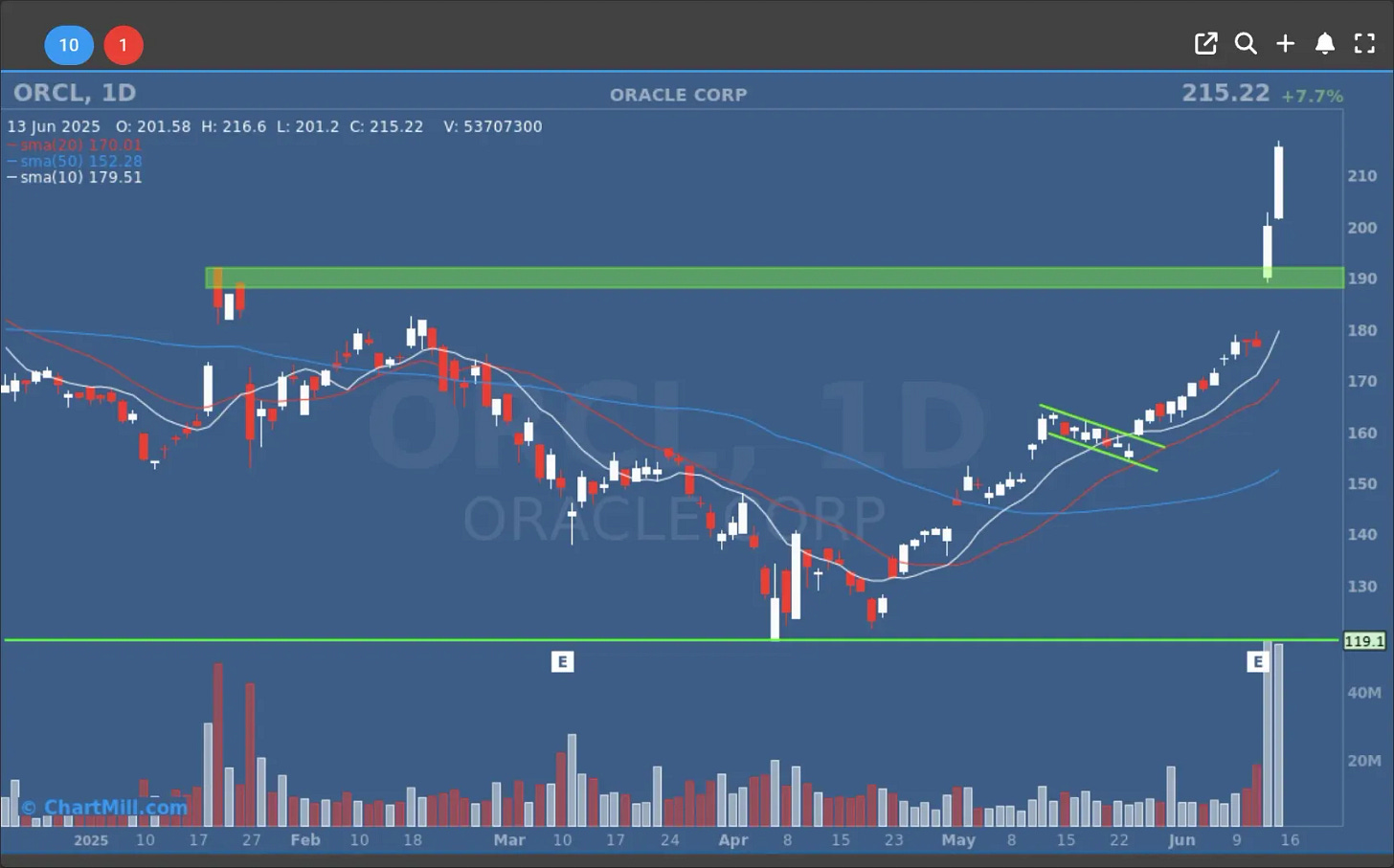

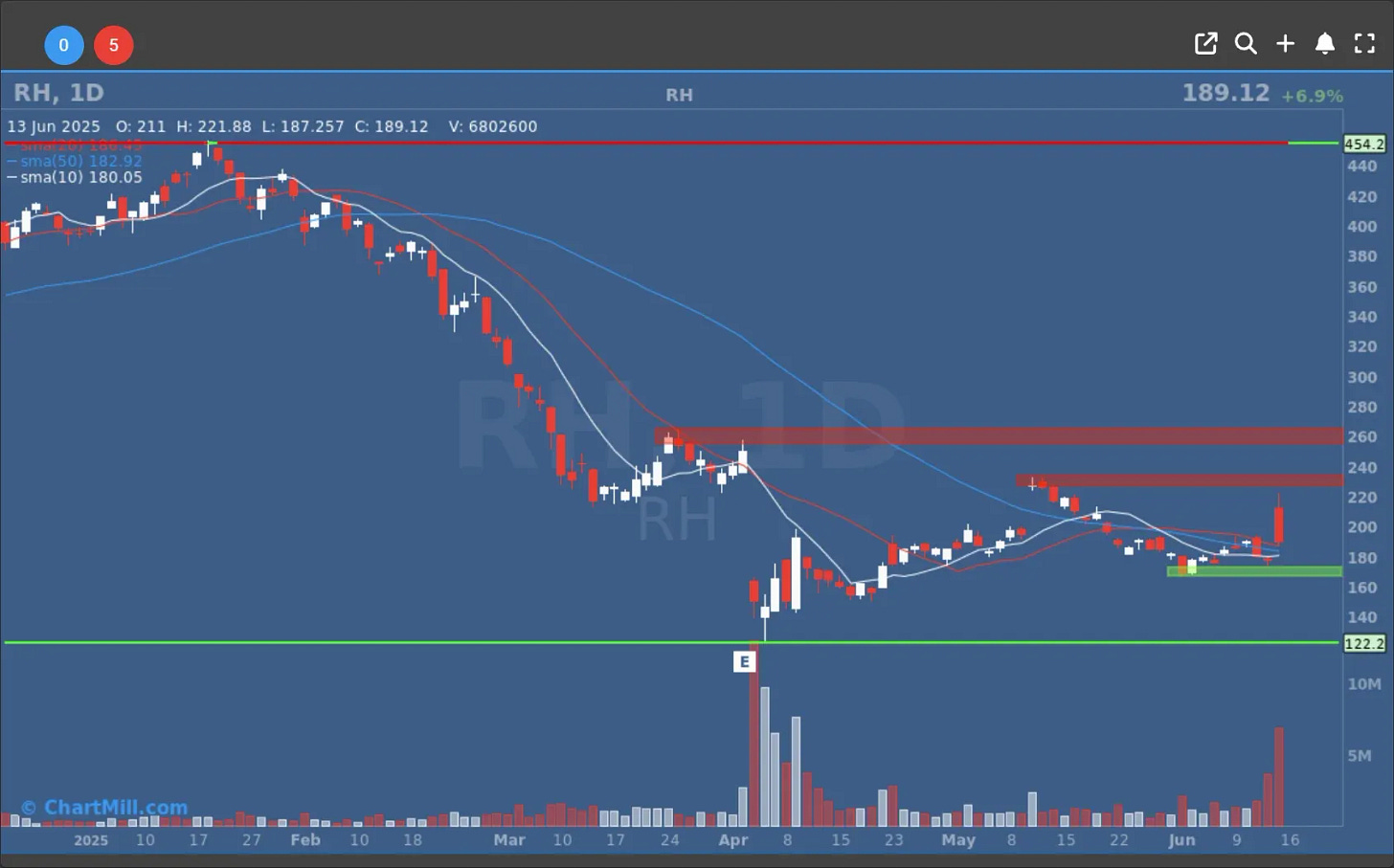

Bright Spots: Oracle and RH

There were a few exceptions to the gloom. Oracle (ORCL | +7.69%) followed up a monster earnings report by adding another 8% on Friday. Momentum traders are all over it, and for good reason, the cloud business is finally showing up in the numbers.

Read our latest article: "Oracle Just Soared 13% on Earnings — Too Hot to Touch, or Still a Buy?"

RH (RH | +6.93%) surprised to the upside as well, swinging back to profitability and guiding confidently. A rare win in the consumer discretionary space.

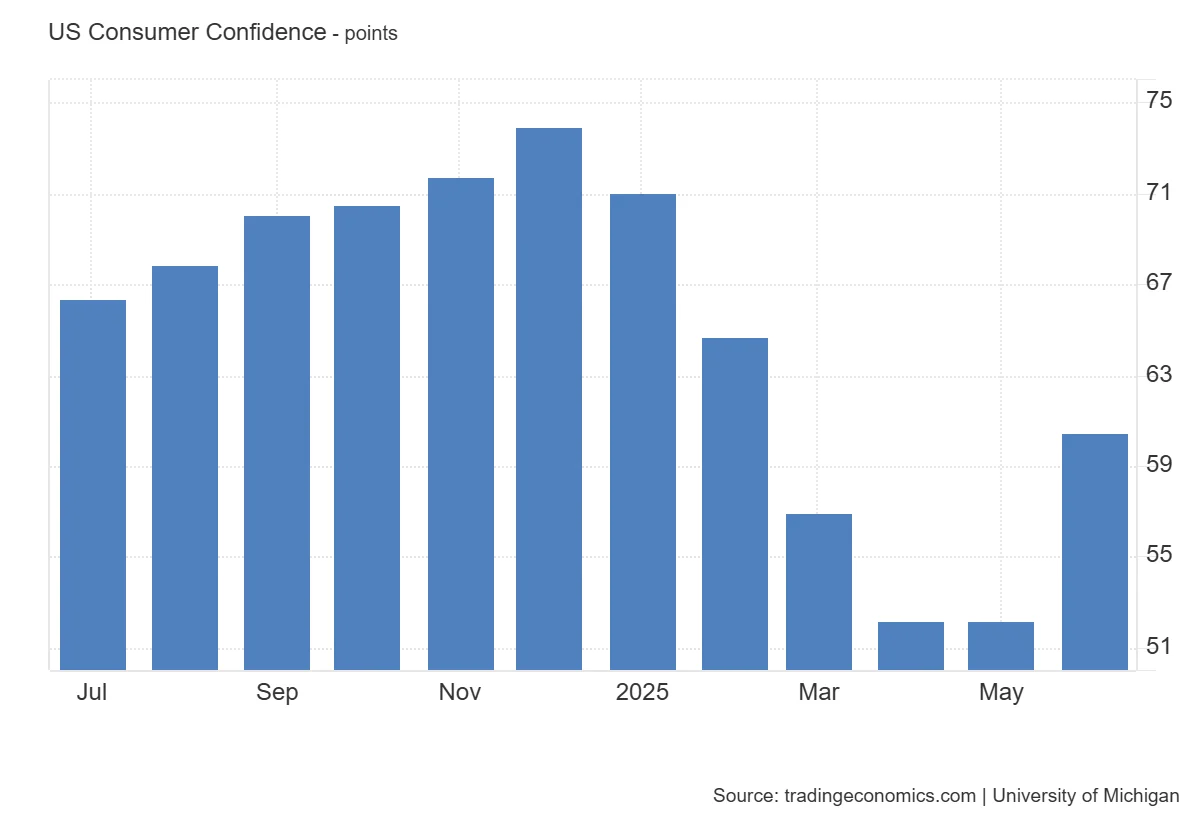

Consumer Data: A Flicker of Hope?

If you’re looking for something positive in the macro picture, consumer sentiment at least moved in the right direction.

The University of Michigan's index climbed from 52.2 to 60.5, while short-term inflation expectations dropped from 6.6% to 5.1%. Still high, yes, but easing. It suggests consumers are slowly digesting recent tariff shocks and stabilizing a bit, though no one’s popping champagne...

Final Thoughts

Days like Friday are why I watch markets so closely. You can have all the technical setups, earnings beats, or policy optimism you want, but when geopolitical reality punches through the noise, price action takes over.

This market is walking on a tightrope, and until we see clear signs of de-escalation in the Middle East, I expect continued choppiness.

If you’re not paying attention, you’re a step behind.

Kristoff - Co-Founder ChartMill

Next to read: ChartMill Market Monitor Trends & Breadth, June 16

👉 This article is also available at ChartMill.com.