Market Breadth & Trends - July 02 BMO

Breadth Check: Market Still Holding Up — But the Momentum Is Looking a Bit Tired

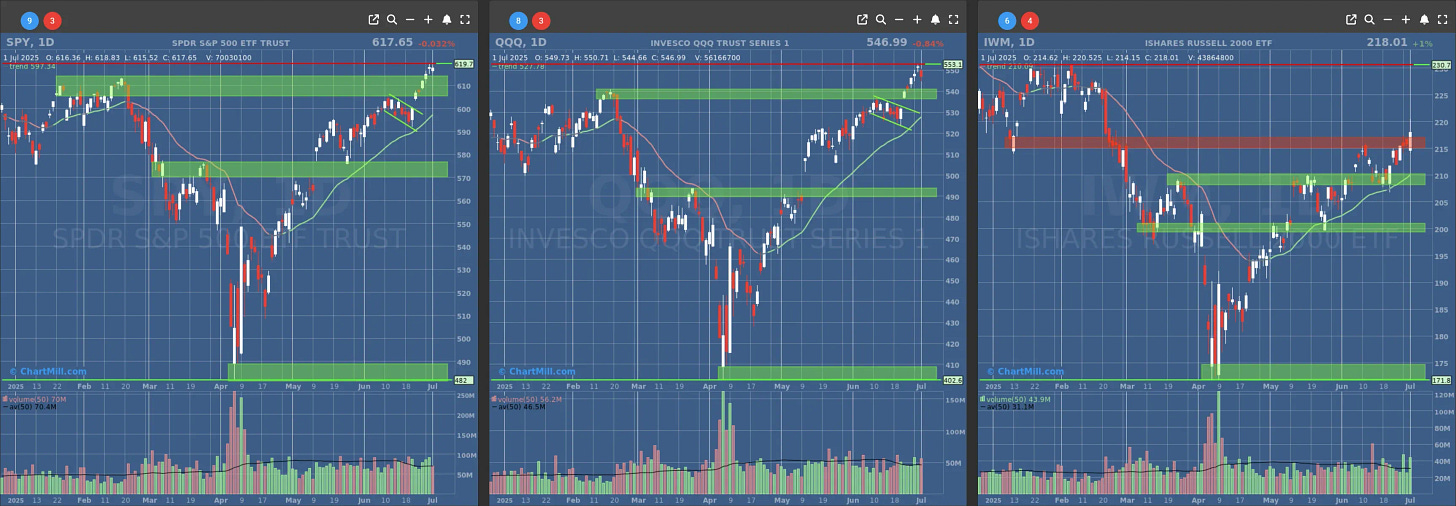

Trend Analysis

Powerful breakout for the Russel 2000 ETF (IWM).

Short Term Trend

Short-Term Trend: Bullish (no change)

Next Support at $600 to $610

Next Resistance at /

Volume: At Average (50)

Pattern: Down Day

Short-Term Trend: Bullish (no change)

Next Support at $540

Next Resistance at /

Volume: Above Average (50)

Pattern: Down Day

Short-Term Trend: Bullish (no change)

Next Support at $210

Next Resistance at $215 to $220

Volume: Above Average (50)

Pattern: Bullish Engulfing, breakout above resistance

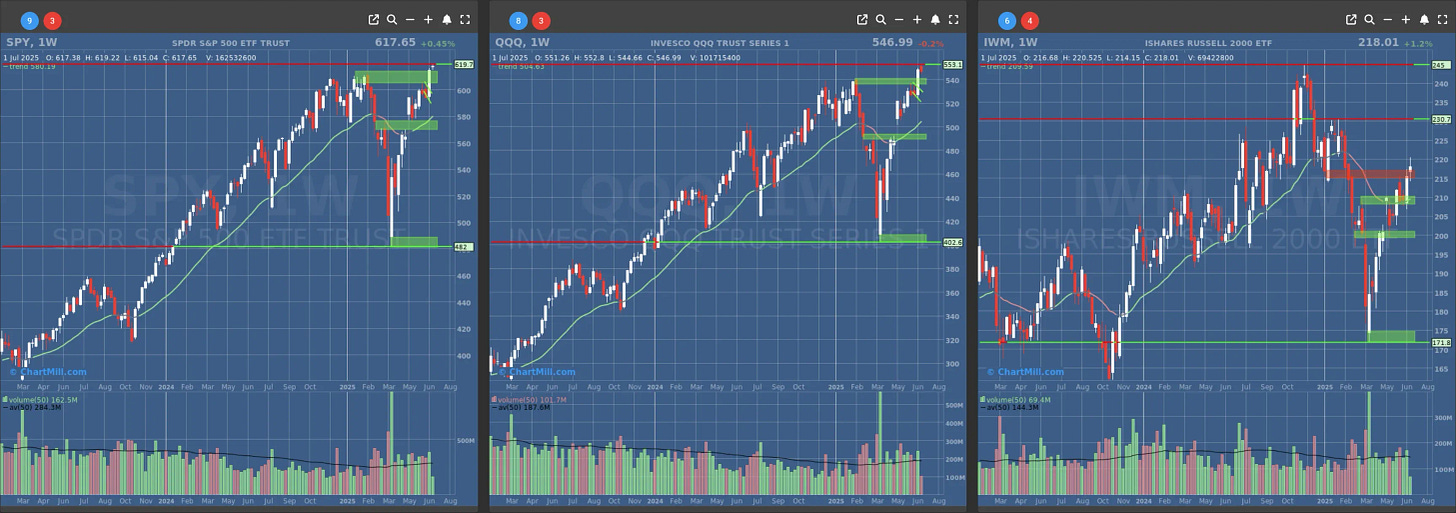

Long Term Trend

Long-Term Trend: Positive (no change)

Long-Term Trend: Positive (no change)

Long-Term Trend: Positive (changed from neutral) - not confirmed, weekcandle closes on friday

Daily Market Breadth Analysis – July 01, 2025 (After Market Close)

Market internals for Monday, July 1, 2025, suggest that bulls are still in control, but not quite marching in formation like they were last week. The breadth remains constructive, but the strength is becoming a little uneven beneath the surface.

Let’s dig into what the numbers say and how they compare to Friday’s robust finish.

Advancers vs. Decliners: Still Positive, But Softening

After Friday’s solid 60.5% advancers, Monday cooled slightly to 59.4%, while decliners crept up to 38.3%. Not a red flag, but a small signal that the upside thrust might be running out of steam, or taking a well-earned pause after the strong June finish.

More notably, the number of stocks advancing more than 4% rose to 6.9%, doubling Friday’s 3.3%. That’s encouraging, some real strength in select names, even if the index-level movement was muted. Meanwhile, only 2.7% of stocks fell more than 4%, which is still relatively low and stable.

Moving Average Participation: Strength Persists Across Timeframes

Here's where the bullish picture still holds up clearly. The percentage of stocks trading above key moving averages ticked higher across all key timeframes:

Above 20-day SMA: 71.5% (up from 68%)

Above 50-day SMA: 75.5% (up from 72.9%)

Above 100-day SMA: 65.4% (up from 62.2%)

Above 200-day SMA: 51% (up from 48.9%)

Crossing above 50% on the 200-day SMA is a key milestone. It tells me the market isn’t just riding short-term momentum, it’s now broadly showing long-term technical strength.

This kind of across-the-board advance usually aligns with market-wide buying pressure, not just a few mega caps dragging everything up.

New Highs and Lows: Stable, But Not Exciting

New Highs (NH): 5.4%

New Lows (NL): 0.7%

New highs came down slightly from 7.1% on Friday, but it’s still a healthy margin over the new lows. Nothing dramatic, just a little consolidation after Friday’s exuberance. Ideally, we’d want NH to accelerate from here to signal another leg higher. For now, it’s “good enough.”

Weekly and Monthly Breadth Trends: Longer-Term Trends Hold Strong

Looking at the weekly and monthly advancing trends, there's confirmation of strong participation across timeframes:

Weekly Advancers: 68% (vs. 71.7% on Friday)

Monthly Advancers: 73.3% (vs. 71.7% on Friday)

We’ve now seen four straight sessions where more than 68% of stocks are up on the month, and over 70% are trading above their 20-day SMAs. That’s not just a bounce, that’s sustained broad participation.

The Takeaway: Solid Internals, But Watch for Signs of Fatigue

The market breadth remains healthy, make no mistake. Participation across all timeframes is expanding, new highs still outnumber new lows, and the long-term moving average stats look impressive.

But some metrics, like fewer new highs and a slight drop in the weekly momentum, hint that we could be entering a consolidation phase.

This cooling is not entirely unexpected. After June’s ramp-up and with a shortened holiday week ahead (hello July 4th), it’s natural for traders to de-risk slightly. What I’ll be watching tomorrow is whether the strength re-accelerates or quietly stalls.

One thing’s clear: as of Monday, the bulls are still in charge, but they may be shifting from a sprint to a slow jog.

Kristoff - Co-founder, ChartMill

Next to read: ChartMill Monitor News, July 02

👉 This article is also available at ChartMill.com.