Altria Stock (MO): A Potential Breakout as Cannabis Stocks Regain Momentum

Cannabis stocks are rallying after reports of potential U.S. regulatory easing. This article analyzes Altria (MO) as a potential late mover, combining a bullish setup with indirect cannabis exposure.

Introduction

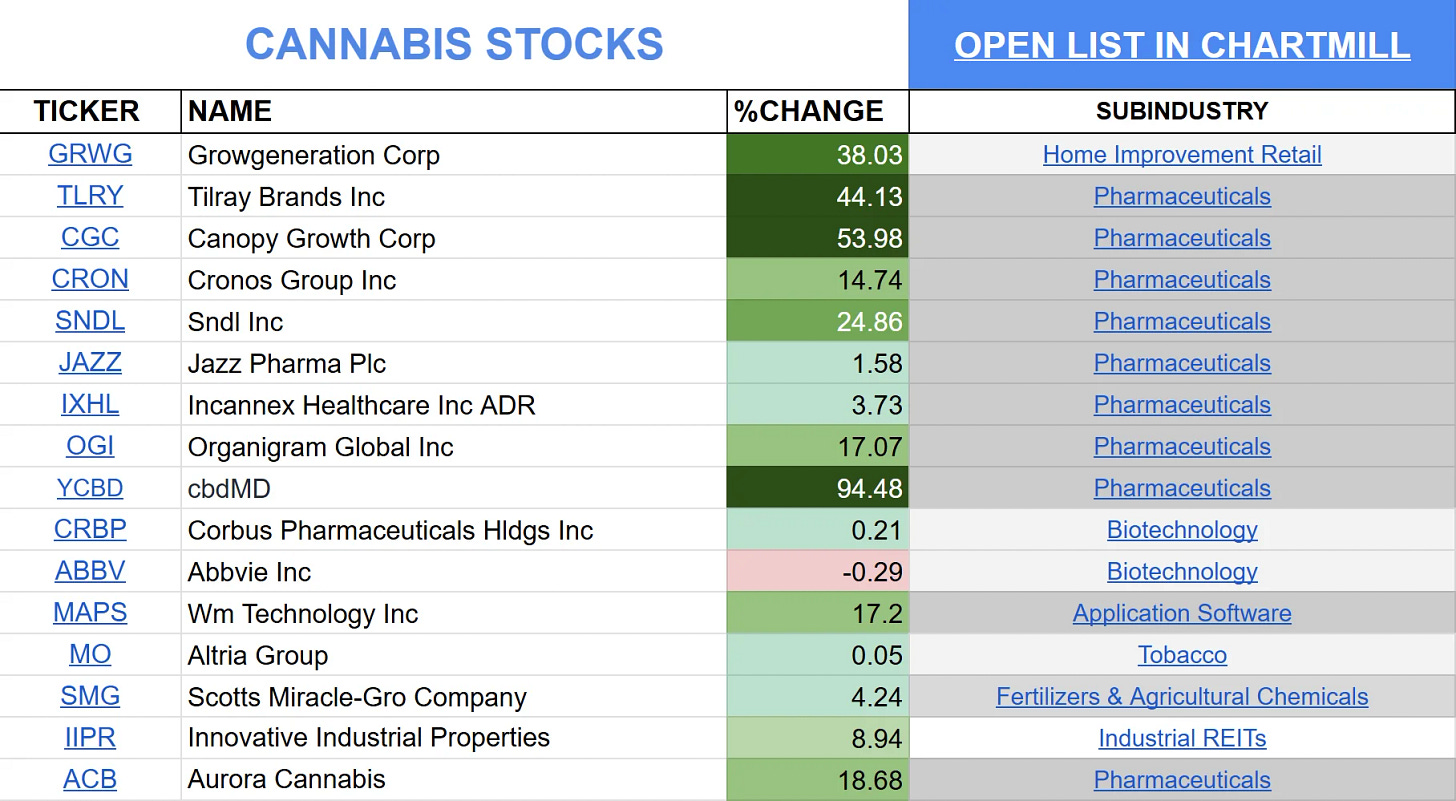

On December 12, 2025, multiple media outlets reported that President Trump is considering instructing his administration to reclassify cannabis at the federal level from a Schedule I to a Schedule III substance. While no final decision has been made, the market reaction was immediate, with several cannabis-related stocks posting sharp gains.

Such political catalysts often trigger sector-wide momentum moves. In the initial phase, investors and traders typically focus on the most direct and volatile cannabis names. In a subsequent phase, attention often shifts toward larger, more defensive companies with indirect exposure to the theme.

One potential ‘late mover’ in this context is Altria Group Inc. (NYSE: MO). While the stock has not yet staged a clear breakout, the price chart suggests an interesting technical setup that could benefit from continued sector momentum.

This article first briefly outlines the broader move in cannabis stocks, before taking a closer look at the technical and fundamental case for Altria.

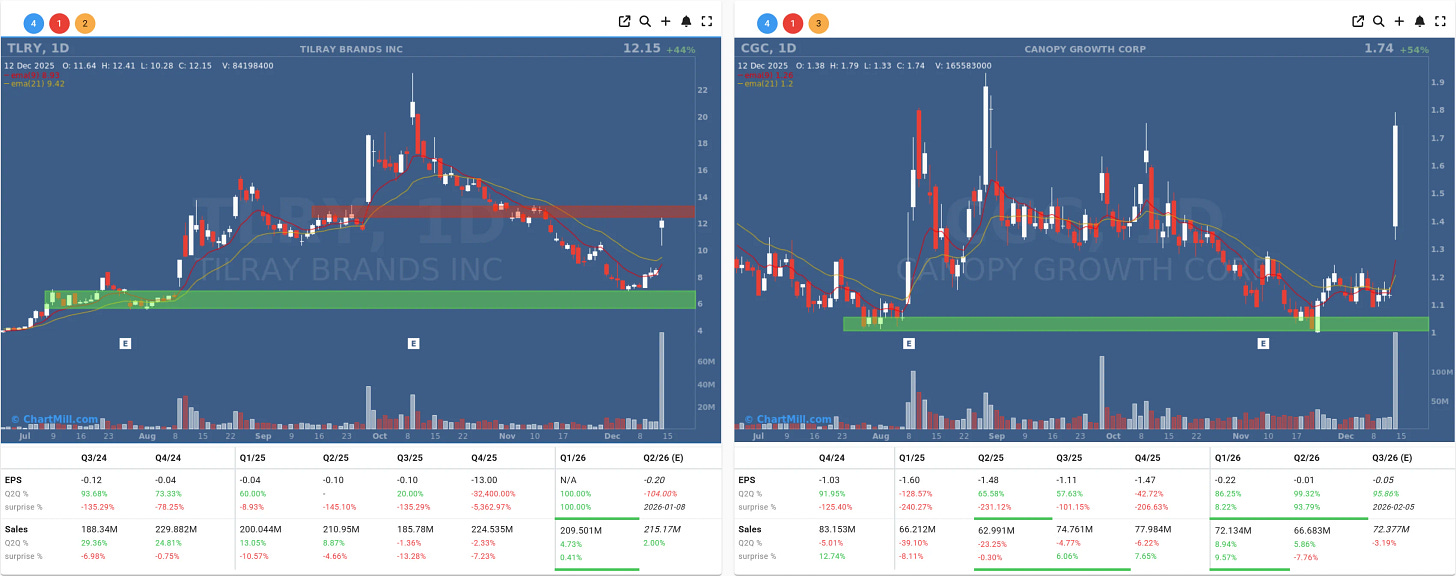

Renewed momentum in cannabis stocks

Open this list in the stock screener

The news surrounding a possible easing of cannabis regulation acts as a classic sector-wide catalyst. In these situations, market behavior often unfolds in two distinct phases:

First wave: capital flows into the most volatile companies with direct exposure to the cannabis industry.

Second wave: investors rotate into larger, more defensive names with indirect exposure to the theme.

Altria fits more clearly into this second category. The company combines stable revenue streams from traditional tobacco products with strategic exposure to the emerging cannabis market. As a result, the stock is often slower to react during the initial hype phase but can benefit later if thematic momentum persists.

Altria Group: company overview

Altria Group is best known as an established player in the tobacco industry, supported by strong brands and consistent cash flows. At the same time, the company has gradually diversified its revenue base in recent years, including through investments and strategic positions related to the cannabis sector.

This combination results in:

Relatively stable earnings

Strong free cash flow generation

Downside support through dividends

Optional upside through cannabis-related exposure

From a fundamental perspective, there is currently limited cannabis-related optimism priced into Altria’s valuation, which can make the stock attractive in a thematic rotation.

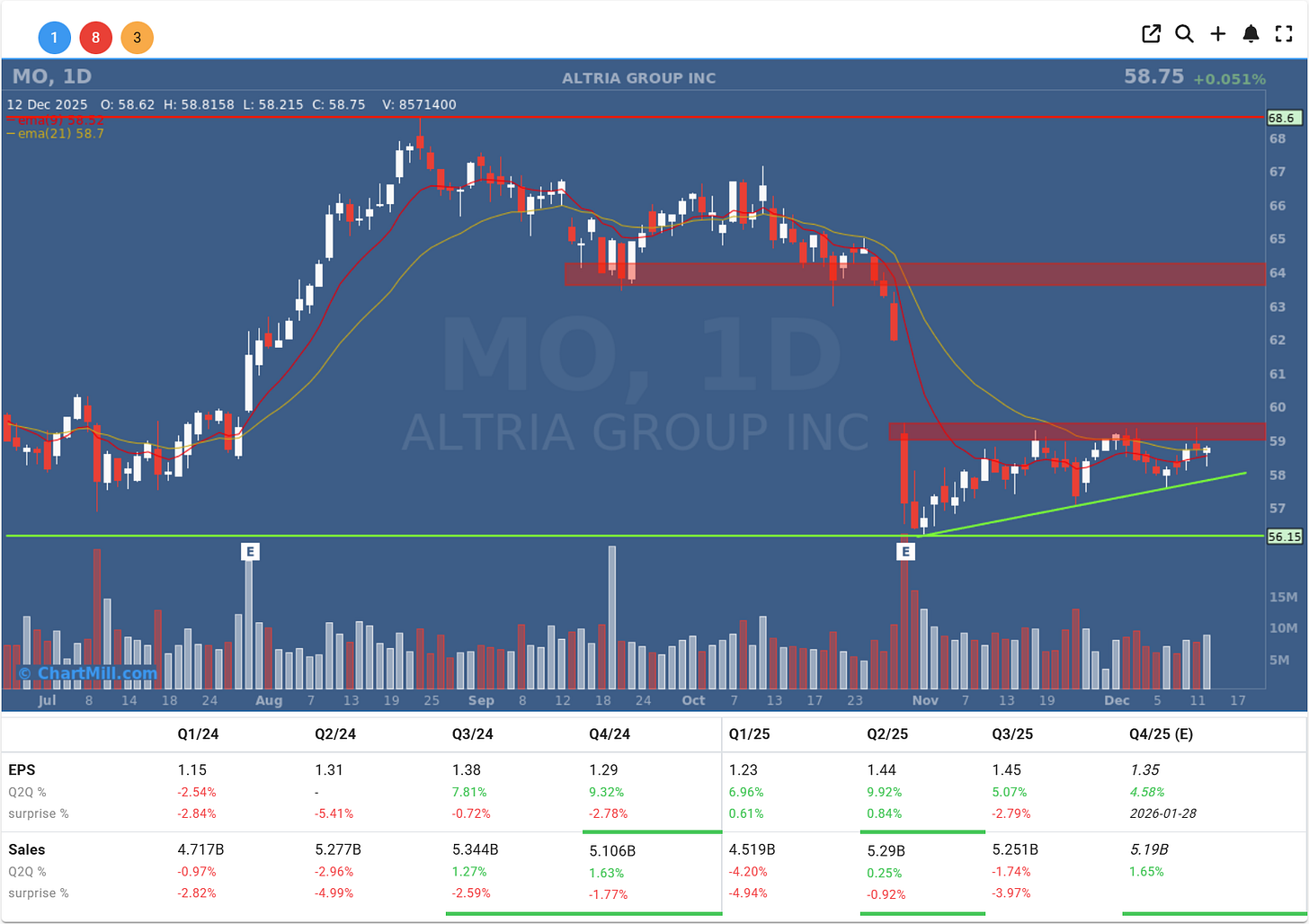

Technical analysis: a potential breakout in the making

Ascending triangle pattern

On the daily chart, Altria is forming a clear ascending triangle pattern:

Higher lows since early November, supported by an upward-sloping trendline

A horizontal resistance zone around 58.90 – 59.40

Contracting volatility, pointing to price compression and a build-up of energy

This pattern is typically interpreted as a bullish breakout setup, provided resistance is broken decisively.

Trend and moving averages

The short-term moving averages shown on the chart support the improving technical picture:

Price is trading above both the 9-day EMA (red) and the 21-day EMA (yellow)

The 9-day EMA is about to cross above the 21-day EMA, indicating a strengthening of short-term momentum.

Both moving averages are turning higher, indicating increasing buying pressure

Together, these signals suggest that downside momentum has faded and that the prior downtrend has largely been neutralized.

Key technical levels

Resistance

58.90 – 59.40: horizontal supply zone and breakout level

Support

57.50 – 58.00: lower boundary of the triangle pattern

56.15: key structural support level

A daily close above 59.40 would technically confirm a breakout. As long as price remains above 56.15, the constructive technical scenario remains intact.

Scenario analysis

Bullish scenario

A convincing breakout above resistance would open the door for a continuation move toward:

61.90 (Gap Close)

63.50 – 64.00 (former distribution area)

This scenario becomes more likely if sector-wide momentum in cannabis stocks continues.

Neutral scenario

If price is temporarily rejected near 59 but continues to form higher lows above 57.80, the consolidation remains constructive. Further compression could lay the groundwork for a later breakout.

Bearish scenario

A daily close below 56.15 would invalidate the ascending triangle and return the stock to a broader consolidation range.

Conclusion

The recent rebound in cannabis stocks is being driven by a clear political catalyst that has rapidly shifted sentiment across the sector. In such environments, market focus often rotates from pure, high-volatility cannabis names toward larger, more diversified companies that have not yet fully participated in the move.

Altria Group fits well within this framework. The company combines stable cash flows and dividend support with indirect exposure to the cannabis sector. From a technical perspective, the stock is also in a clear compression phase within an ascending triangle pattern.

For investors and traders, the actionable takeaway lies around the 59.40 level. A decisive breakout and daily close above this zone could serve as the trigger for a new upward move, bringing higher price targets back into play. As long as the stock holds above its key support levels, Altria can be viewed as a potential ‘late mover’ within the renewed cannabis theme.

Kristoff - ChartMill